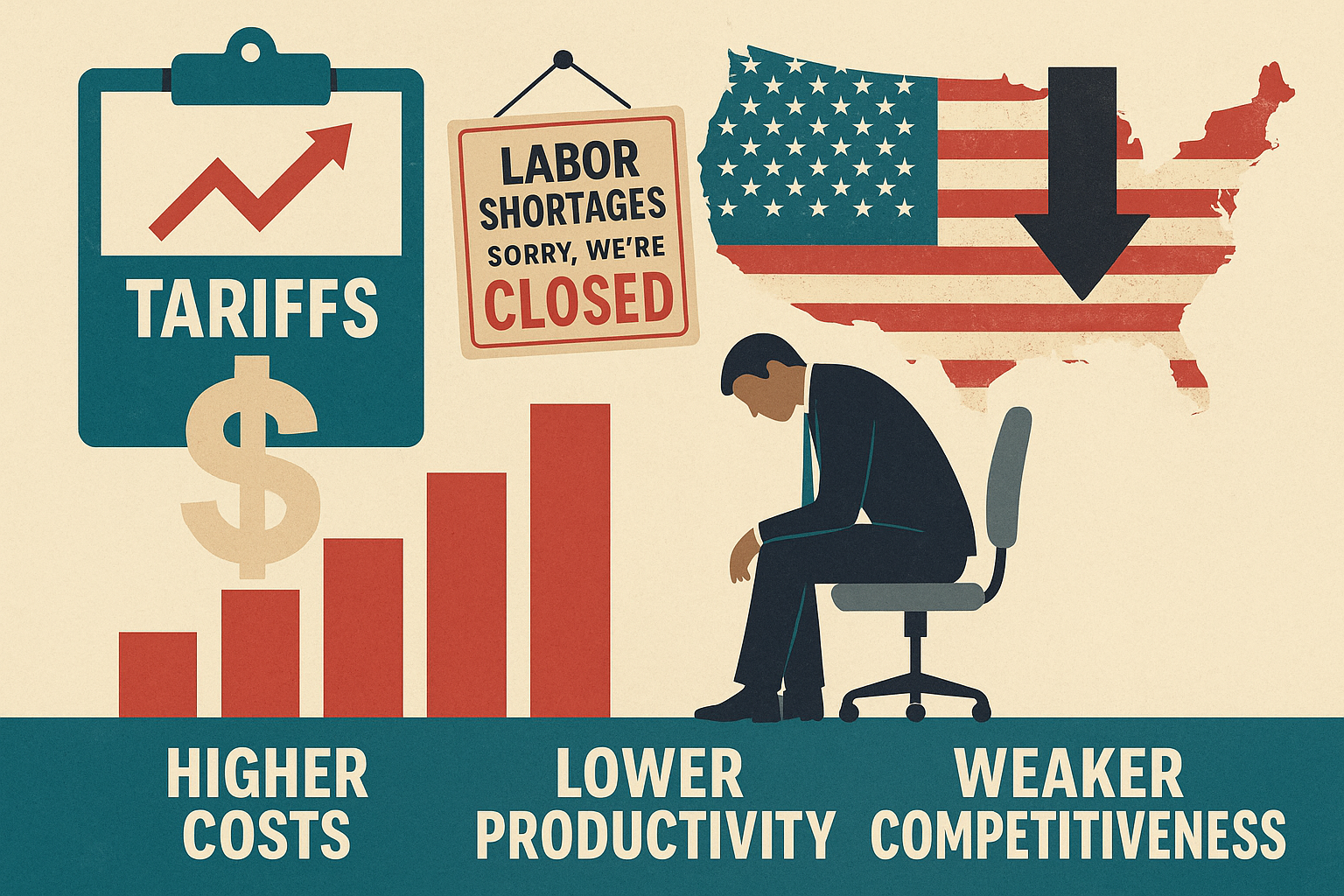

The U.S. Face a Triple Hit: Higher Costs, Lower Productivity, and Weaker Competitiveness

Are you aware the United States has 5% of the world's population and consumes 25% of the world’s goods and services? It is not possible for this segment of the population to internally produce 25% of the world’s consumable goods and services to avoid a trade imbalance. The premise of the current administration is unachievable without dire consequences for the U.S. and world economies.

The current economic policies of the U.S. concerning the imposition of tariffs will result in higher consumer prices, supply chain disruption, reduced global trade volume, empower competitors like China, and erode U.S. economic leadership.

When paired with the loss of a manual labor population due to the current U.S. immigration Policy, the United States will see further increase of the price of food, materials, delays and bottlenecks in construction (including housing) further spurring on inflation. These policies will increase wage pressures, diminish skills, and create an inflationary feedback loop.

The Macroeconomic effect of these two policies will create an inflation surge for food, housing and infrastructure costs – all at the same time. We will see a GDP drag due to slower construction and weaker agricultural exports, pollical and social stress.

When tariffs and labor shortages overlap, the U.S. faces a triple hit: higher costs, lower productivity, and weaker competitiveness. Food prices spike, construction slows, and inflation accelerates — all while U.S. exports lose ground.